Today, as we observe the Fourth of July holiday in the U.S, we hope you have a happy and safe celebration.

There has been a lot of recent talk about the possibility of a global recession, as central banks around the world raise interest rates aggressively to reduce demand and bring inflation under control. In the United States, GDP growth in the first quarter of 2022 was negative, and if Q2 growth also turns out negative, then the U.S would technically be in a recession already. Early signals suggest that Q2 growth will likely be positive but there is a lot of uncertainty.

Unlike today's low unemployment and high consumer demand, a global recession would be accompanied by lots of people losing jobs and spending less money on goods and services. This means lower earnings for businesses and their shareholders, like yourself. Not all businesses would be affected to the same extent, so it makes sense to shift dollars within a portfolio towards companies that might be more resilient in a recession. A good question to ask, then, is what are various indicators telling us about whether the U.S is in a recession and, what is the likelihood of a U.S recession in the near future.

Today, our team uses three broad categories of macro indicators to get a clearer picture of the states of the economy and financial markets: (i) indicators that tell us where we are currently in the business cycle; (ii) indicators that tell us where in the cycle we are likely to be in a year; and (iii) indicators that tell us how volatile financial markets currently are.

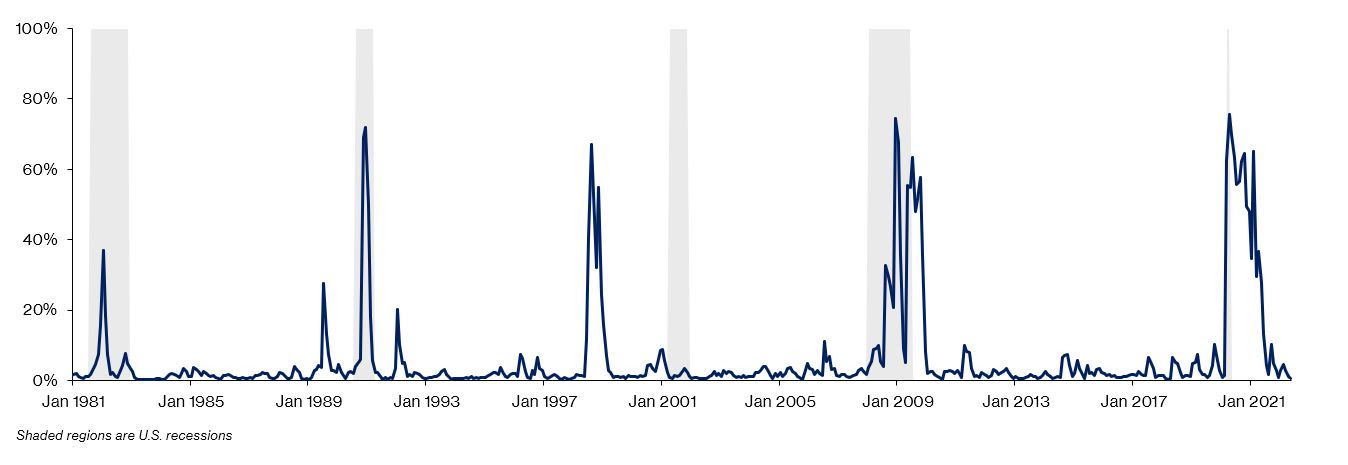

First, we take snapshots of the current state of the economy using purely real economic data i.e., non-financial data that is adjusted for inflation. We pay particular attention to how much households are spending on durable goods like washing machines and refrigerators. People tend to hold off on these kinds of purchases when they are worried they might lose their jobs. This information is useful for telling us how likely it is that we are currently in a downturn (it's weird but technically we can only confirm in hindsight whether a recession has started or ended!). As with what real-time Q2 GDP estimates are showing, our models suggest that the US economy is likely not currently in a recession (see chart below).

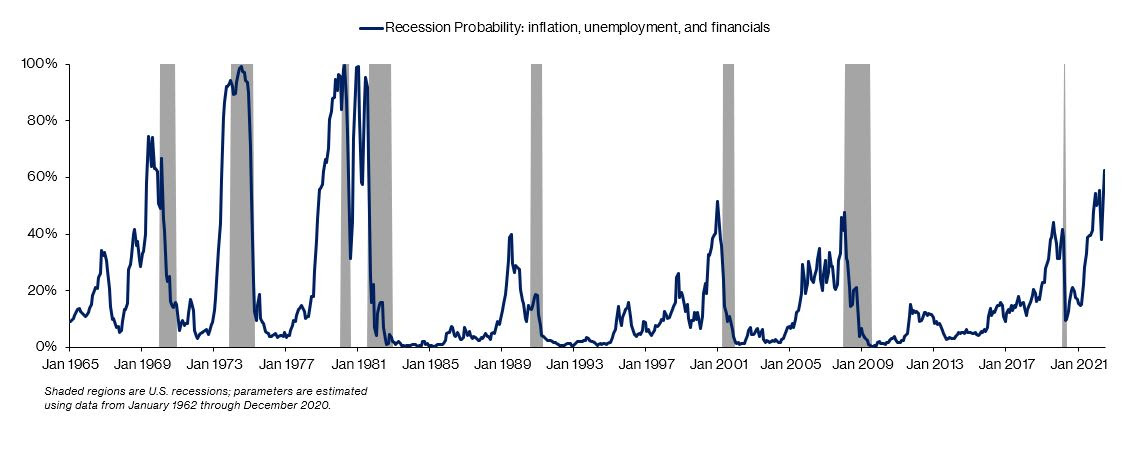

Next, following work by U.S Fed economists, we use a combination of unemployment, inflation, term premia — the extra cost of borrowing over longer horizons, and credit premia — the extra cost of borrowing that less-than-stellar borrowers pay, to predict the likelihood of a recession twelve months from now. This model appears to do a decent job of matching recession data historically. As you can see in the chart below, the likelihood of a recession in the near future is estimated to be currently relatively high, above 50 percent. Remember that this is an estimate. It is impossible to say for sure whether there will be a recession soon. Macroeconomic forecasts are notoriously inaccurate. Indeed, we got the call wrong last year on how high and persistent inflation would run.

Finally, while we work hard not to be governed neither by greed nor fear, we are paying close attention to short-term market volatility to get a sense of tail risk —the unlikely risk of large losses. Today, this measure is currently above its historical average yet pales in comparison to the global financial crisis of 2008-09. Overall, this points to higher-than-normal volatility and calls for a cautious approach to allocating dollars in our portfolio.