As you may know, we employ a systematic approach when deciding how much money should be invested in each stock we own. We believe this approach helps us ensure a repeatable strategy that puts emotions aside when investing. The process is based on several years of R&D going back as far as 2014.

We continue to improve our process with a focus on delivering better-than-average risk-adjusted returns over the long term. Our workflow is simple: explore the latest concepts, test them thoroughly in our backtest across different market conditions, and deploy only the best ideas to client portfolios.

Well today, we are excited to share some improvements to our systematic process that are based on the autoregressive conditional heteroskedasticity (ARCH) modeling concept pioneered by Robert Engle for which he was awarded the Nobel Prize in 2003.

The concept is simple: How much stock prices move up and down (i.e. volatility) is time-dependent. Volatility today might be based on stock market performance yesterday. In fact, the data shows that trading days with high volatility tend to be followed by trading days with high volatility; and similarly for days with low volatility. This is called temporal dependence. Our previous models—which focused more on the downside co-movement of stock prices—implicitly ignored this temporal dependence, treating each trading day as independent from the last; and that's not good enough. Accounting for temporal dependence when forecasting volatility can help one better manage risk.

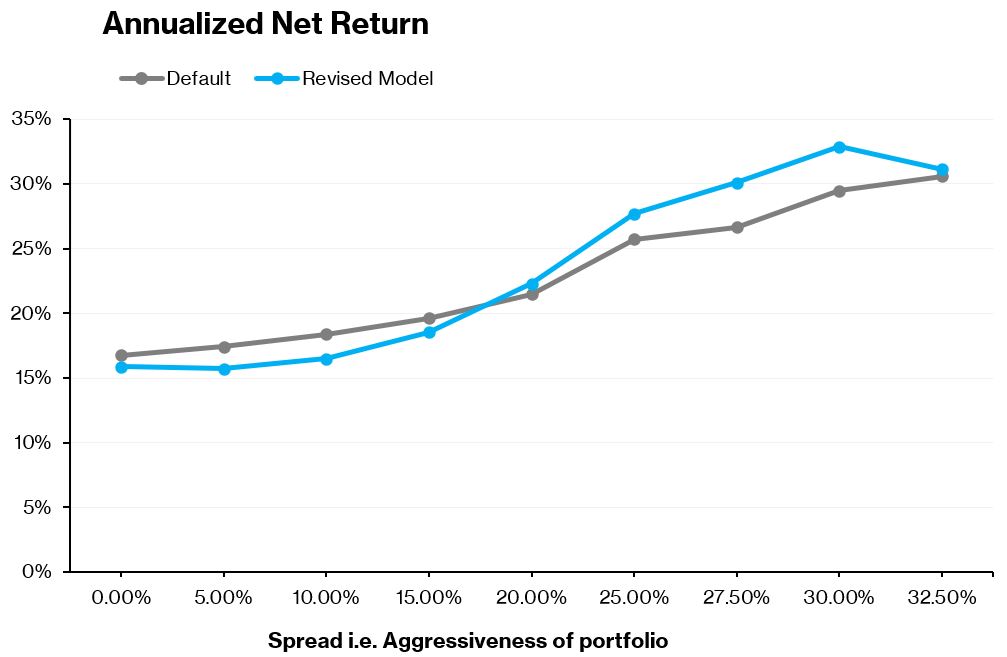

From the get-go, we incorporated a way to specify how much risk we were willing to take on for a given portfolio. We call this knob, spread—a higher spread means more risk or a more aggressive portfolio; a lower spread means ... you get the idea. We explored several models based on Engle's ARCH for levels of aggression and compared those models' performance to our current model, looking back about two decades.

The result below speaks for itself. For what we consider moderate to aggressive risk tilts (i.e. spread above 20%), the best-performing updated model significantly outperforms our baseline. The peak difference in annualized performance is quite significant, as much as 2% (or 200bps) on an annualized basis. Seasoned investors know that an extra 200bps compounds to almost 1.5x extra gains over two decades. That's a major win, even for backtest results! You can find more details in this white paper.

Also notable is that the additional gains do not come at the cost of higher volatility. In other words, for our target risk tilts—where most of our portfolios typically operate—the risk-adjusted returns are much better with these changes.

There is a lot more to do here and we are very grateful to Luyang Zhang from UC Santa Barbara for his immense contributions during his 3+ month summer internship with the firm.